Key takeaways

- US trade policy outcomes are set to shape the FX narrative in the coming weeks…

- …posing two-sided risks to the USD, barring material escalation in tariffs…

- The more optimistic could see the AUD and NZD strengthening against the USD.

Our tactical view

Table of tactical views where a currency pair is referenced (e.g. USD/JPY):An up (⬆) / down (⬇) / sideways (➡) arrow indicates that the first currency quotedin the pair is expected by HSBC Global Research to appreciate/depreciate/track sideways against the second currency quoted over the coming weeks. For example, an up arrow against EUR/USD means that the EUR is expected to appreciate against the USD over the coming weeks. The arrows under the “current” represent our current views, while those under “previous” represent our views in the last month’s report.

USD

We look for the USD to move mostly sideways over the coming few weeks. While risks are still skewed towards weakness, especially with US policy and structural concerns, the prospect of cyclical drivers (like interest rate differentials) getting more traction could give the USD some protection so long as evidence of US economic resilience continues to emerge. US data releases, such as the non-farm payroll report (1 August) and CPI (12 August), will add some colour on this front. The Federal Reserve (Fed) is widely expected to keep its policy rate unchanged at its 29-30 July meeting, but a more pressing potential factor to worry the USD is the continued pressure on the Fed’s independence. It is also worth monitoring how the USD responds to US trade policy developments around the 1 August deadline. Higher tariff outcomes may be viewed as USD-positive (given its ‘safe haven’ status), but trade deals with lower tariff levels could support risk appetite that may weigh on the USD. Trade developments pose two-sided risks to the USD.

Short-term direction : DXY^

Current

▶ Track Sideways

Previous

▶ Track Sideways

EUR

The EUR still enjoys an unusually large premium relative to interest rate differentials, which assume a ‘good case’ outcome on EU-US trade policy. In addition, the EUR is increasingly attuned to risk appetite. In our view, risks are skewed towards EUR weakness, amid a renewed “risk on” persona (if trade tensions intensify) and weak economic activity. Data releases, such as Euro Area GDP (Advanced Estimate) for 2Q (30 July), CPI for July (1 August) and ZEW survey report (12 August), could help shape market expectations ahead of the European Central Bank’s (ECB) meeting on 11 September where a c50% chance of an ECB rate cut is currently in the price (Bloomberg, 22 July 2025).

Short-term direction : EUR-USD

Current

▶ Track Sideways

Previous

▶ Track Sideways

Short-term direction : EUR-GBP

Current

▶ Track Sideways

Previous

▲ Appreciate

GBP

The traditional drivers (like rates and risk appetite) seem to have little traction for the GBP. The GBP has the upside of already securing a trade deal with the US, but cyclical headwinds and the lack of fiscal headroom may prevent a rally. The Bank of England (BoE) is likely to deliver a rate cut on 7 August, with markets seeing a c80% chance for this to happen; but UK economic data has not built the case for an accelerated easing pace thereafter. The labour market report (12 August), 2Q GDP (14 August) and CPI for July (20 August) could shed light on the BoE’s policy path.

Short-term direction : GBP-USD

Current

▶ Track Sideways

Previous

▶ Track Sideways

JPY

The ruling Liberal Democratic Party (LDP)-Komeito coalition failed to hold onto its majority in the Upper House election on 20 July, which is likely to keep the JPY weak for now. Future fiscal concerns have already impacted the JPY, while the Bank of Japan (BoJ) is likely to keep its rate unchanged on 31 July (Bloomberg, 22 July 2025). On a positive note, Japan has secured a trade deal with US sooner than expected. US reciprocal and sectoral auto tariffs on Japan will both be lowered to 15% (from 25%). As such, there is a tug of war for influence (less tariff uncertainty versus more domestic uncertainty) over the JPY.

Short-term direction : USD-JPY

Current

▲ Appreciate

Previous

▼ Depreciate

Short-term direction : EUR-JPY

Current

▲ Appreciate

Previous

▼ Depreciate

CHF

Pharmaceuticals comprise c40% of total Swiss exports. A 200% tariff on pharmaceuticals (if enacted by the US) would be negative for Switzerland’s balance of payments in the long run but could encourage front-loading over the near term, which may be CHF-positive. The market strategy is to “assume the best”, which creates skewed risks around the 1 August tariff deadline, probably supporting the CHF. The possibility of the Swiss National Bank’s (SNB) FX intervention could still provide a ceiling on CHF strength.

Short-term direction : USD-CHF

Current

▼ Depreciate

Previous

▼ Depreciate

Short-term direction : EUR-CHF

Current

▼ Depreciate

Previous

▶ Track Sideways

CAD

The main scope for idiosyncratic moves in USD-CAD will likely come through interest rate expectations, courtesy of shifts in US-Canada trade policy. This could be a greater risk to the CAD, as we approach the 2026 renegotiation of the United States-Mexico-Canada Agreement (USMCA) in earnest later this year. With both the Bank of Canada and the Fed likely on hold in their respective July meetings (30 July), and trade policy potentially neutral, USD-CAD should consolidate over the coming weeks.

Short-term direction : USD-CAD

Current

▶ Track Sideways

Previous

▶ Track Sideways

AUD

The favourable external environment (like expectations of monetary and fiscal easing globally), Australia’s ample fiscal capacity, and potentially a higher FX hedge ratio could support the AUD over the coming few weeks. The Reserve Bank of Australia (RBA) surprised markets by holding rates unchanged in July, but markets fully price in a 25bp cut by the RBA on 12 August (Bloomberg, 22 July 2025). AUD-USD could also be marginally supported by less front-loaded RBA easing.

Short-term direction : AUD-USD

Current

▲ Appreciate

Previous

▲ Appreciate

Short-term direction : AUD-NZD

Current

▶ Track Sideways

Previous

▼ Depreciate

NZD

NZD-USD is likely to go higher, probably driven by similar external forces to AUD-USD. Markets see a c85% chance of a 25bp cut by the Reserve Bank of New Zealand on 20 August (Bloomberg, 22 July 2025). With both central banks likely easing, AUD-NZD is likely to stay rangebound.

Short-term direction : NZD-USD

Current

▲ Appreciate

Previous

▲ Appreciate

Note: ^DXY = US Dollar Index, is an index (or measure) of the value of the USD against major global currencies, including the EUR, JPY, GBP, CAD, SEK and CHF. N/A = Not applicable, as we only provide short-term direction for those currency pairs from this issue. Source: HSBC

FX Data Snapshot

(from close on 23 June to 23 July*)

Heading and description can't be both empty

| FX |

Spot |

200 dma |

1-month % change* |

Support |

Resistance |

|---|---|---|---|---|---|

| DXY |

97.44 | 103.46 | -0.99% | 96.38 | 98.95 |

| EUR-USD |

1.1748 | 1.0911 | 1.47% | 1.1550 | 1.1830 |

| EUR-GBP | 0.8678 | 0.8413 | -1.36% | 0.8575 | 0.8740 |

| GBP-USD | 1.3538 | 1.2966 | 0.10% | 1.3360 | 1.3680 |

| USD-JPY |

146.72 | 149.67 | -0.39% | 145.00 | 149.20 |

| EUR-JPY | 172.36 | 163.12 | -1.83% | 170.00 | 175.50 |

| USD-CHF |

0.7919 | 0.8621 | 2.63% | 0.7800 | 0.8070 |

| EUR-CHF | 0.9303 | 0.9389 | 1.12% | 0.9220 | 0.9390 |

| USD-CAD | 1.3596 | 1.4049 | 1.02% | 1.3420 | 1.3800 |

| AUD-USD |

0.6576 | 0.6394 | 1.80% | 0.6400 | 0.6688 |

| AUD-NZD | 1.0905 | 1.0954 | -0.89% | 1.0900 | 1.0955 |

| NZD-USD |

0.6030 | 0.5839 | 0.89% | 0.5900 | 0.6120 |

| FX |

DXY |

|---|---|

| Spot |

97.44 |

| 200 dma |

103.46 |

1-month % change* |

-0.99% |

| Support |

96.38 |

| Resistance | 98.95 |

| FX |

EUR-USD |

| Spot |

1.1748 |

| 200 dma |

1.0911 |

1-month % change* |

1.47% |

| Support |

1.1550 |

| Resistance | 1.1830 |

| FX |

EUR-GBP |

| Spot |

0.8678 |

| 200 dma |

0.8413 |

1-month % change* |

-1.36% |

| Support |

0.8575 |

| Resistance | 0.8740 |

| FX |

GBP-USD |

| Spot |

1.3538 |

| 200 dma |

1.2966 |

1-month % change* |

0.10% |

| Support |

1.3360 |

| Resistance | 1.3680 |

| FX |

USD-JPY |

| Spot |

146.72 |

| 200 dma |

149.67 |

1-month % change* |

-0.39% |

| Support |

145.00 |

| Resistance | 149.20 |

| FX |

EUR-JPY |

| Spot |

172.36 |

| 200 dma |

163.12 |

1-month % change* |

-1.83% |

| Support |

170.00 |

| Resistance | 175.50 |

| FX |

USD-CHF |

| Spot |

0.7919 |

| 200 dma |

0.8621 |

1-month % change* |

2.63% |

| Support |

0.7800 |

| Resistance | 0.8070 |

| FX |

EUR-CHF |

| Spot |

0.9303 |

| 200 dma |

0.9389 |

1-month % change* |

1.12% |

| Support |

0.9220 |

| Resistance | 0.9390 |

| FX |

USD-CAD |

| Spot |

1.3596 |

| 200 dma |

1.4049 |

1-month % change* |

1.02% |

| Support |

1.3420 |

| Resistance | 1.3800 |

| FX |

AUD-USD |

| Spot |

0.6576 |

| 200 dma |

0.6394 |

1-month % change* |

1.80% |

| Support |

0.6400 |

| Resistance | 0.6688 |

| FX |

AUD-NZD |

| Spot |

1.0905 |

| 200 dma |

1.0954 |

1-month % change* |

-0.89% |

| Support |

1.0900 |

| Resistance | 1.0955 |

| FX |

NZD-USD |

| Spot |

0.6030 |

| 200 dma |

0.5839 |

1-month % change* |

0.89% |

| Support |

0.5900 |

| Resistance | 0.6120 |

Note: * as at 15:22 HKT on 23 July 2025

Source: HSBC, Bloomberg

Explanation of terms

Spot: Spot refers to the current market price of a currency pair that is important for immediate transactions.

200 dma: 200-day simple moving average numberrepresents the average price of an index or a currency pair over the past 200 days.

Support (S), Resistance (R):Support and resistance are significant previous lows and highs plus retracement levels, based on historical price patterns of anindex or a currency pair. Support is a historical price level where a downtrend of a currency pair paused due to demand for the first currency quoted in the pair increasing, while resistance is a historical price level where an uptrend of a currency pair reversed amid demand for the second currency quoted in the pair increasing.

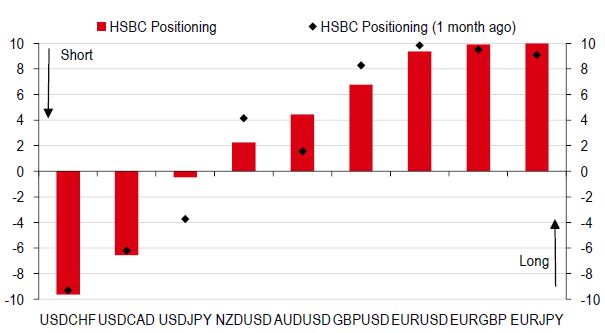

HSBC Positioning Indices

The indicators have been devised to track the net position of momentum traders, looking at hundreds of strategies, operating over many different time horizons. It considers time horizons of 5 days up to 260 days. An indicator level of +10 would indicate that the hundreds of different strategies have all lined up and gone long (i.e., buy the first currency quoted in the pair). Similarly, an indicator level of -10 indicates that all strategies are short (i.e., sell the first currency quoted in the pair).

Glossary

Dovish

Dovish refers to an economic outlook which generally supports low interest rates as a means of encouraging growth within the economy.

Hawkish

Hawkish is typically used to describe monetary policy which favours higher interest rates, and tighter monetary controls to keep inflation in check.

MoM / YoY

Month on month / Year on year

PMI

Purchasing Managers Index (PMI) is an indicator of economic health of the manufacturing sector (>50 represents expansion vs. the previous month).

IMM data

International Monetary Market (IMM) is a division of the Chicago Mercantile Exchange (CME) that deals with the trading of currencies and interest rate futures and options and the IMM data is part of the Commitments of Traders (COT) reports published by the U.S. Commodity Futures Trading Commission (CFTC). The IMM data provides a breakdown of each Tuesday’s open futures positions on the IMM. Speculative positions are a trader’s non-commercial positions (i.e. not for hedging purposes).

G10

G10 refers to the most heavily traded, liquid currencies in the world: USD, EUR, JPY, GBP, CHF, AUD, NZD, CAD, NOK, and SEK.

Fed / FOMC

Federal Reserve System (US’s Central Bank)/Federal Open Market Committee.

ECB

European Central Bank (Eurozone’sCentral Bank).

BOE

Bank of England (UK’s Central Bank).

BOJ

Bank of Japan (Japan’s Central Bank).

BOC

Bank of Canada (Canada’s Central Bank).

RBA

Reserve Bank of Australia (Australia’s Central Bank).

RBNZ

Reserve Bank of New Zealand (New Zealand’s Central Bank).

SNB

Swiss National Bank (Switzerland’s Central Bank).

Related insights

FX Viewpoint: USD: Bottoming out yet?

The USD narrative has been negative so far this year…[21 Jul]

FX Viewpoint: AUD and NZD: July’s rate pause amid trade uncertainty

The RBA kept rates on hold in July, despite widespread expectations for a 25bp cut. [14 Jul]

FX Viewpoint: Gold momentum fading?

Gold prices could spike higher on geopolitical events...[7 Jul]

Important information

Important disclosures

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Information in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments (including derivatives) of companies covered in HSBC Research on a principal or agency basis.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

Additional disclosures

- This report is dated as at 23 July 2025.

- All market data included in this report are dated as at close 22 July 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business.Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

Disclaimer

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available, HSBC Bank (China) Company Limited, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, HSBC Investment and Insurance Brokerage, Philippines Inc, and HSBC FinTech Services (Shanghai) Company Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high-level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third-party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”): HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India does not distribute or refer investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or any other jurisdiction where such distribution or referral would be contrary to law or regulation.

HSBC India is an AMFI-registered Mutual Fund Distributor of select mutual funds and a referrer of other 3rd party investment products. HSBC India will receive commission from HSBC Asset Management (India) Private Limited, in its capacity as a AMFI registered mutual fund distributor of HSBC Mutual Fund. The Sponsor of HSBC Mutual Fund is HSBC Securities and Capital Markets (India) Private Limited (HSCI), a member of the HSBC Group. Please note that HSBC India and the Sponsor being part of the HSBC Group, may give rise to real, perceived, or potential conflicts of interest. HSBC India has a policy in place to identify, prevent and manage such conflict of interest. For more information related to investments in the securities market, please visit the SEBI Investor Website: https://investor.sebi.gov.in/ and the SEBI Saa₹thi Mobile App. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Issued by The Hongkong and Shanghai Banking Corporation Limited India. Incorporated in Hong Kong SAR with limited liability. HSBC Bank ARN - 0022 with validity from 19-Feb-2024 to 18-Feb-2027. Date of initial registration: 19-Feb-2002.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): HBID is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Investment products that are offered in HBID are third party products, HBID is a selling agent for third party products such as Mutual Funds and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) do not guarantee the underlying investment, principal or return on customer’s investment. You must read and understand the investment policy of each investment product to see if a product contains ESG and sustainability elements and is classified as an ESG and sustainable investment. Investment in Mutual Funds and Bonds are not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (“LPS”).

Important information on ESG and sustainable investing

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.

In broad terms “ESG and sustainable investing” products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as sustainable may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t consider these factors. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION.

YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.