The latest IMF World Economic Outlook (WEO) has delivered some hefty downward revisions to global growth forecasts for the next couple of years. As recently as January, the same economists were sounding upbeat on the outlook for both developed and emerging markets. But faced with radical uncertainty in the macro and market environment in 2025, their tone has turned undeniably bearish.

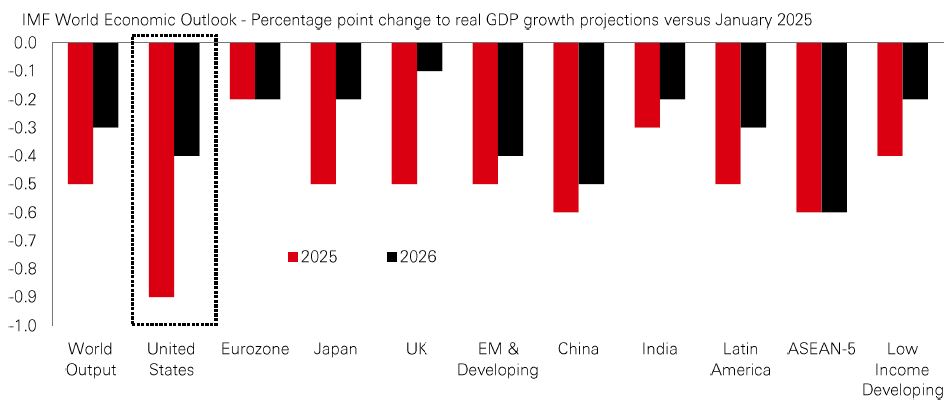

Near term, the WEO’s reference forecast (based on data as of 4 April) shows global growth is projected to fall from an estimated 3.3% in 2024 to 2.8% in 2025, before bouncing back to 3% in 2026. Compared to January’s expectations, those projections represent a 0.5 percentage point fall for 2025, and 0.3 percentage points for 2026. And there have been downward revisions for nearly all countries. At the extreme, the US has seen a sharp downgrade to its growth forecast for 2025, which now stands at 1.8%.

These revisions reflect recent disappointing data on real activity, and now major policy shifts in global trade – despite signs that the US administration may be considering a more dovish approach to negotiations. They follow a similarly downbeat report from the WTO the previous week showing the volume of world merchandise trade is projected to fall by 0.2% in 2025. That’s almost three percentage points lower than it would have been without the recent policy developments.

Put simply, swingeing cuts to US growth expectations is more evidence that we could be seeing the end of US exceptionalism. And as the US catches down to the rest of the world, investors are likely to eye global opportunities that have long been out of favour. But with radical uncertainty thrown into the mix, it’s likely to be bumpy out there.